A period of increasingly free and open world trade that has characterized the past decades appears to be ending, replaced by a new and more challenging era of international commerce. This will pose a significant challenge to most product companies with international operations. Even as they have honed their ability to balance supply and demand, companies are more vulnerable to supply chain issues when events disrupt the smooth flow of goods and services. Organizations can address this vulnerability by enhancing their ability to adapt quickly to environmental changes.

I recently summarized some of the key findings of our S&OP research1. Our analysis suggests that many companies that deal in physical products are doing a mediocre job of sales and operations planning and so may need to identify ways to improve. For instance, half (51% ) of participants rated their company’s S&OP performance only as adequate while fewer than half that amount, 22 percent, said they do it well or very well and another 22 percent think their performance is poor. The results suggest that senior executives in companies with only moderately complex supply chains should pay closer attention to S&OP because of the challenges that they are facing today. It’s likely that achieving more effective supply chain planning and management will grow in importance as the journey to a new trade equilibrium is bound to be bumpy.

Concurrent planning is a relatively new, technology-enabled approach to producing plans and scenarios much faster than cascaded planning. It exploits today’s lower-cost computational power and advanced algorithms to produce plans and scenarios much faster than the cascaded methods that were necessary because of technology and cost constraints. Concurrent planning enables organizations with highly complex planning models to run and rerun scenarios in minutes rather than hours. Planners can develop plans or sets of alternatives fast enough for the projections to be actionable. This capability is critical in the new era of trade.

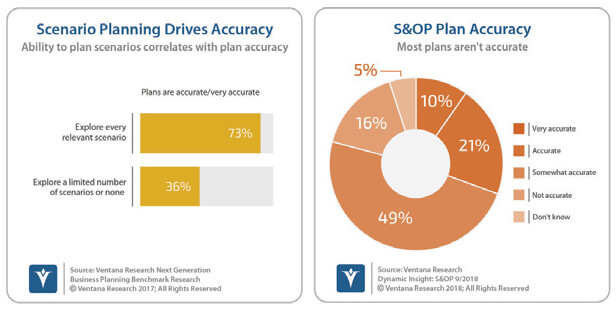

When companies have immediate visibility into the condition of their supply chain they can quickly create and evaluate scenarios for planning purposes or evaluate different courses of action in response to market changes. One finding of our Next-Generation Business Planning benchmark research illustrates the value of quickly assessing multiple scenarios: Three-fourths (73%) of those companies that are able to assess every relevant scenario say their plans are accurate or very accurate, while that’s true of just 36 percent of those that explore only a limited number of scenarios or none at all. Software that allows planners to quickly assess scenario outcomes enables organizations to evaluate more scenarios in the time available.

Our research also finds that one of the main sets of challenges that organizations grapple with involves data: 38 percent said that the necessary data isn’t available; another 30 percent said that their data isn’t accurate. One consequence of bad or unavailable data is that the resulting plans aren’t completely accurate. Only one-third (31%) characterized their S&OP as very accurate or accurate, while half (49%) described theirs as somewhat accurate. Somewhat accurate planning is like somewhat accurate juggling: There are a lot of dropped balls. Likely because it is complex, S&OP challenges a majority of companies.

Organizations with even moderately complex multinational supply chains are facing and will continue to face significant challenges in managing them. Dealing with competitive changes, new technologies, a market-driven proliferation of SKUs, the growing use of contract manufacturers and a proliferation of commerce channels is making supply chain management more difficult. Adding to the challenges are a more uncertain trade environment, unprecedented market volatility and the impacts and costs of ongoing legal, regulatory and taxation changes. Each of these factors makes it that much harder for organizations to make good sourcing, purchasing and production decisions at a pace that maintains market share and profitability and achieves performance targets – in other words, to be agile in supply chain management.

In this environment, senior managers and executives should evaluate how their organization is positioned competitively, taking an especially close look at their ability to do dynamic supply and demand chain contingency planning. All managers and executives with planning responsibilities, and particularly those in organizations that are exposed to significant market volatility, should be alerting senior leadership teams regularly to opportunities and vulnerabilities. They also must ensure that they have the planning tools they need not only to anticipate change but to benefit from it. I recommend that larger companies with even moderately complex supply chains assess the tools they’re using.